Extended bio

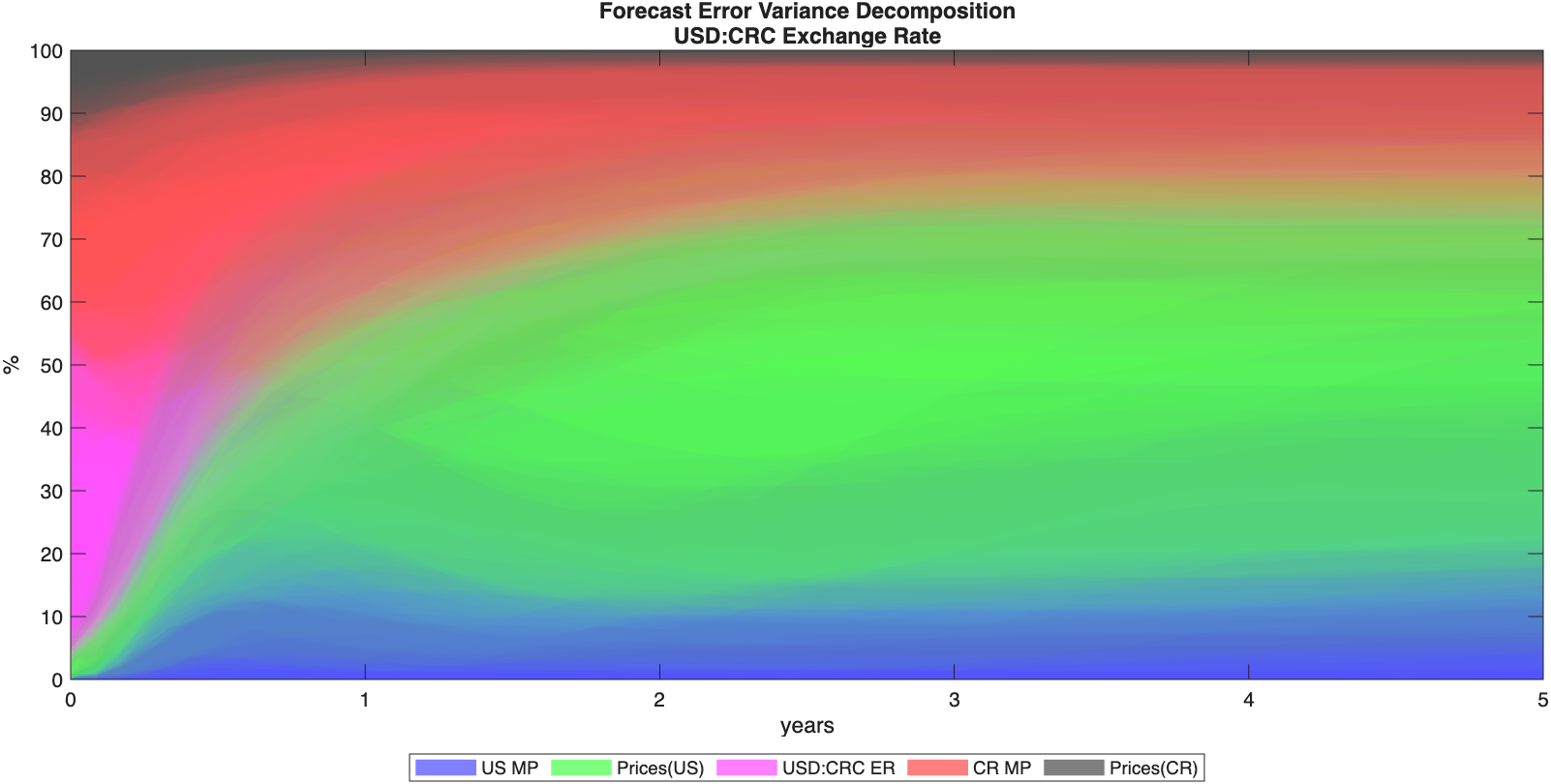

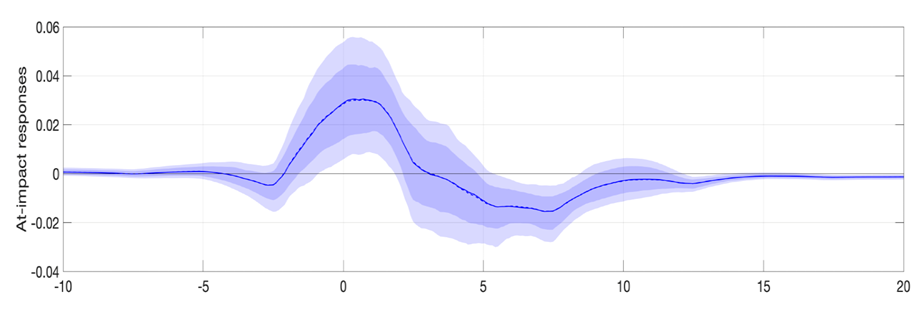

At Lehigh University, Fabio teaches graduate‑level econometrics in the Master of Applied Economics and PhD in Economics programs. His research lies at the intersection of macroeconometrics, monetary policy, and financial markets. He specializes in structural VAR models, functional time series analysis, and exchange rate pass‑through, with particular attention to small open economies such as Costa Rica.

His work examines how monetary and fiscal policy shocks shape inflation expectations, yield curve movements, and exchange rate dynamics. Fabio collaborates with the Central Bank of Costa Rica, contributing to policy‑oriented research on foreign exchange markets and policy transmission mechanisms. Current projects include applying advanced Bayesian econometric methods to large‑dimensional systems and exploring the interaction between systematic and unconditional exchange rate pass‑through.